Contents

When using a demo account, it is not necessary to deposit real money. Optimal selection of trading accounts, each offering different conditions for executing orders, in order to achieve the best results in the chosen trading strategy. We offer accounts with execution at the declared price and market execution , both with a commission and without it. Our trading platforms are supported be Windows, Android, iOS and web-browsers. They grant access to trading and offer an impressive set of analytical instruments to build your own trading strategy. Install our FIBO Drive app to manage your accounts from any Android or iOS device.

Forex traders will be granted access to their new demo account to start trading. Forex traders can visit the official LimeFX website and select the “Open Demo Account” option. Forex traders can also navigate to the Accounts section to view each account’s features and select the option for a demo from there. Swap fees are either credited or debited depending on whether the trader holds a long or short overnight position on a financial instrument. Margin requirements consist of a specific amount, expressed as a percentage, that forex traders must cover at the start of the trade as collateral for the trade. This will depend on the deposit method that forex traders use as some methods are instantaneous while others may take up to three business days.

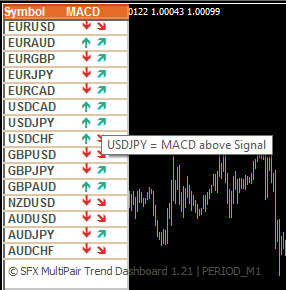

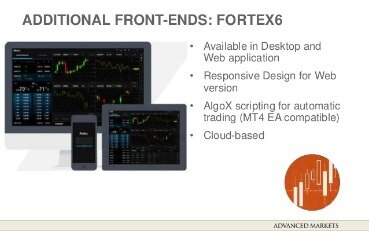

However, LimeFX also offer the cTrader platform for trading Forex using NDD technology. Orders take, on average, less than one millisecond, allowing you to make transactions with minimum slippage. LimeFX offers the trade on Nasdaq through https://limefx.biz/ shares and indices as contracts for difference . LimeFX offers cryptocurrency trading as CFDs and offers Bitcoin, Ethereum, Ethereum Classic, Litecoin, Zcash, Dash, and Monero. The excution is not the the fastest but clearly not the slowest.

Does LimeFX have a mobile app for Forex trading?

Web terminal of the popular MetaTrader4 trading platform by MetaQuotes – friendly trading online. One thing we found a little disappointing was the lack of any educational material. Another unique feature of LimeFX is the chance for you limefx to join the Trading Idea community. This is a rapidly growing community for those of you interested in trading strategies on the US stock market. It includes the Umstel trading strategy which provides direct access to the US stock exchange.

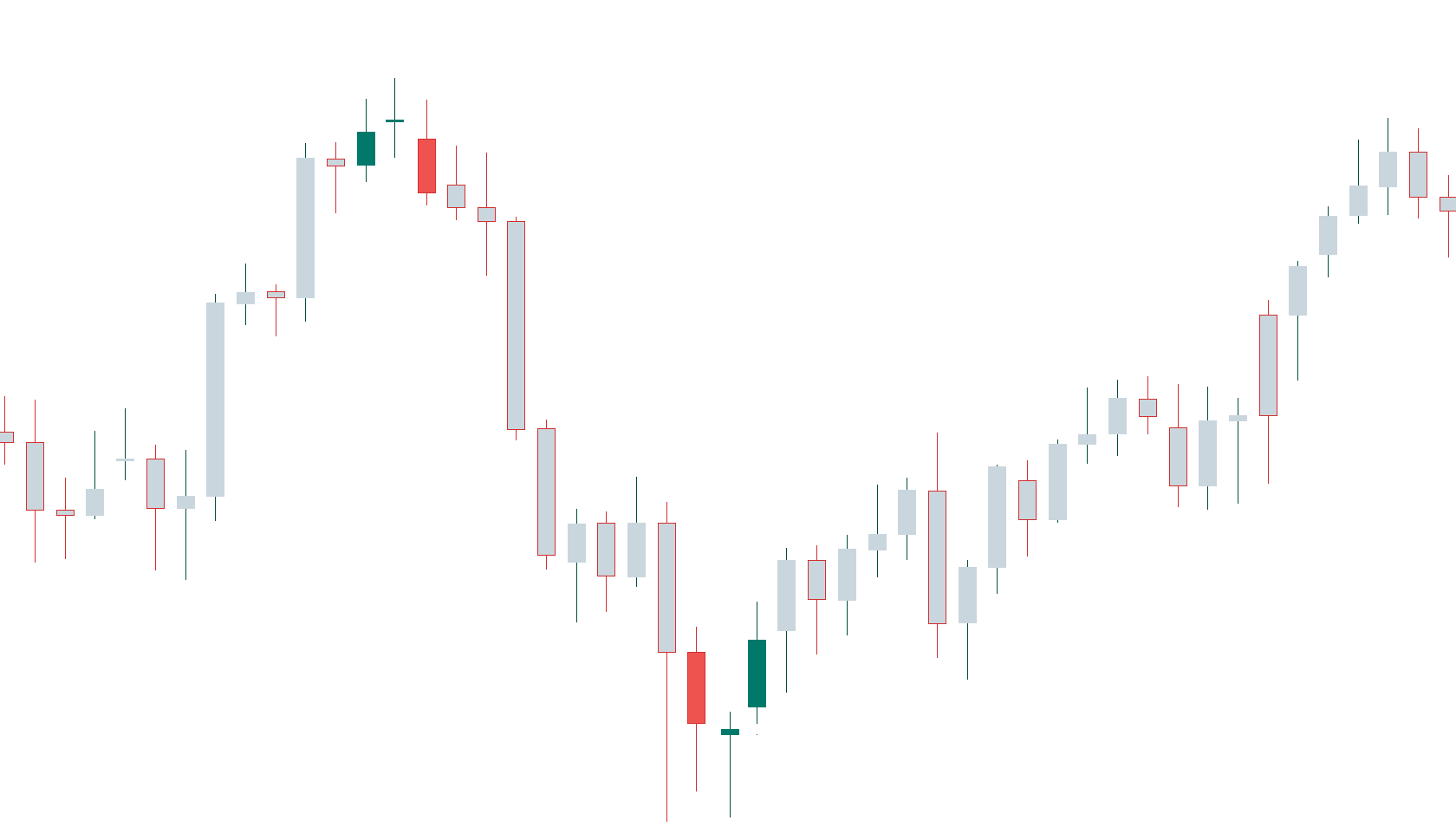

LimeFX’s MetaTrader 4 is the most popular and widely used trading platform that offers forex traders a large variety of trading tools. MetaTrader 4 offers a large range of instruments as well as indicators for technical analysis, a comprehensive news feed, online quotes in real-time, and charting capabilities. The MT4 Cent Account is perfect for beginner forex traders who are still learning and who need to gain trading experience. This account allows for trading in cents, minimizing trading risks while offering competitive trading conditions. LimeFX offers forex traders a free demo account that can be used for practice trading, testing out strategies, and exploring what the broker has to offer without risking any real capital.

How to start trading?

LimeFX is regulated by the FSC in providing financial services and solutions to forex traders. Yes, LimeFX offers online support to forex traders by making a live chat available for use from the official LimeFX website. Online support can be used 24 hours a day, 5 days a week.

However, forex traders must note that this option is only available on the MT4 Fixed Account. According to a Forex Suggest review on LimeFX, in terms of security, trading speed, online support, and for cryptocurrencies, LimeFX is a good broker. No, LimeFX does not have a forex traders dashboard on the official website. Good spreads, tons of pairs, fast execution.LimeFX also has the best deposit and withdrawal system I have ever seen.Instant and no charge. Please read LimeFX Reviews below and share your live trading experiences with this broker. Everything a trader needs to conduct successful trading in financial markets – and much more.

Main major currency pairs:

LimeFX is the name and we’ll start with a little bit of background. Forex traders can select their method of payment, insert the amount they wish to withdraw, their currency, and proceed to the relevant prompts to confirm and process their withdrawal. Forex traders can log into their client area and select the option to withdraw from the account interface.

Forex traders must have valid identification and proof of residential address as part of the “Know Your Client” or KYC and Anti-Money Laundering processes to ensure a secure trading environment. LimeFX makes use of stringent security protocols and guarantees client fund security by keeping funds in segregated accounts, separate from the broker’s own funds. Yes, LimeFX is not regulated in Europe as a forex broker according to the official website.

LimeFX Ltd is registered in the British Virgin Islands where it is licensed to provide LimeFX services and regulated by the FSC. There are various offices located throughout the world including Singapore, Mosco, Munich, Vienna Kiev, and Shanghai. When the company first came into existence it was known as Financial Intermarket Brokerage On-Line and started life as an LimeFX consulting firm in 1998. It wasn’t until 2003 that internet trading in the Forex market was added as a service.

- And for this reason it can have Ctrader only with BVI and not with Cysec.

- We are now one of the largest players in the Forex and CFD markets in the world.

- All times in the site will be translated to your local time.

- Online support can be used 24 hours a day, 5 days a week.

All times in the site will be translated to your local time. Compare broker See what benefits one offers over the other. Find Your Broker We helped new traders to find their path. According to the official LimeFX website, the broker does not currently run any contests. There is no indication of whether LimeFX has offered such contests in the past or whether it may be in development for the future. There is a weekly $50 fee per standard lot on certain forex pairs whereas others will have a fee of $150 applied.

How many days do deposits take with LimeFX?

Then complete a few simple steps to register an actual trading account, which will provide you with a full service package and the ability to make money on Forex. LimeFX has been operating in the Forex industry since 1998. There are two main centers of operation, both of which are licensed and regulated. In Europe, LimeFX Holdings Ltd is a company with offices in Limassol Cyprus, and as such comes under the regulation of CySEC.

Trading conditions, deposit/withdrawal of funds

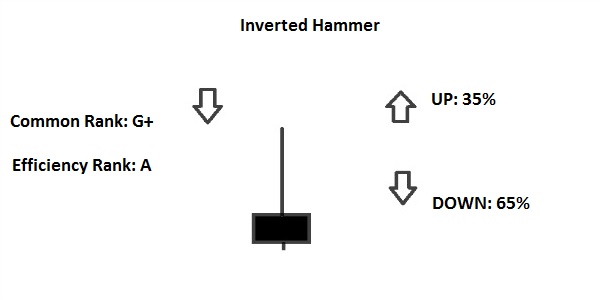

The spread is the difference between the bid/ask price indicated in pips. Floating spreads are determined by the financial instrument and market conditions. Commissions are charged as a flat fee per lot, per side, or per round turn. The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose.

Internet trading in the Forex market is the main business area of the company. We are happy to share our expertise and the technologies we use with our customers. Additionally, you will be able to trade in the CFD market. Customers are offered MetaTrader 4, one of the best internet trading programs currently available.

I have no idea about how traders like to be treated, but I feel quite upset, disappointed and dissatisfied FIBO is the only responsible. LimeFX is the LP of it self – for this reason it has cancelled my profits from ctrader .. And for this reason it can have Ctrader only with BVI and not with Cysec. I have lost more than $ in Fibogroup forex Broker in 28 feb 2020, because they reduced my leverage from 1.100 to 1.50 in MT4 platform & 1.100 to 1.33 in cTrader platform at the end of the week.

CTrader platform provides access to trading on the currency exchange markets using the NDD technology for professional traders and for newbies as well. It allows users to trade with the international banks directly, avoiding any intermediaries in the live trading atmosphere. As a result of some religious beliefs, there are some forex traders that cannot trade under standard conditions and for this reason, LimeFX offers an Islamic Account option to forex traders.

Forex Broker’s Bonuses

The broker has been on the market for more than 20 years and continues to develop, attracting the attention of more and more clients. In 2023, January through December, all of our clients can participate in a ‘Triathlon’ competition with a Managed PAMM account funded with $25000 as a reward, and even more! But the main prize for everyone is a new trading experience and useful knowledge you’ll get. I have been trading with the LimeFX for over a year under My friend recommendation.

● if you’re a profitable trader then don’t go with this broker. Make a deposit on the account in the section “Methods of depositing and withdrawing funds.” Guaranteed execution of limit orders, stop losses (S/L) and take profits (T/P) at stated price.

.jpeg)

.jpeg)